The energy star label is now available for electric heat pump water heaters as well.

Tankless water heater oregon tax credit.

Unless stated otherwise tax credits listed below are up to 50 percent of the cost of the device or 1 500 whichever is less on any one application.

State of oregon income tax credit.

The credit amount for gas oil propane water heaters including tankless units is 300.

Tankless water heater tax credits are often part of an initiative to improve a nation s overall carbon footprint or lower average energy use through the tax code.

A tankless water heater tax credit is a government s tax credit to citizens who take advantage of switching to a more energy efficient tankless hot water heater.

Tax credit eligibility requirements for each device are described in the retc administrative rules ors 469b 100 118 and ors 316 116.

225 state tax credit for ef of 82 849.

The state of oregon is offering a tax credit for heat pump water heaters.

300 state tax credit for tier 1 heat pump water heaters.

600 state tax credit for tier 2 heat pump water heaters ge rheem.

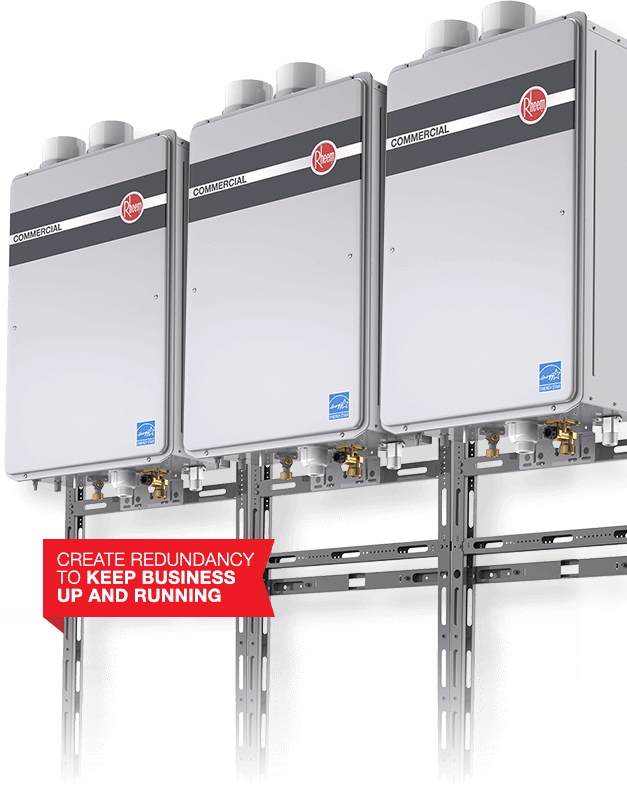

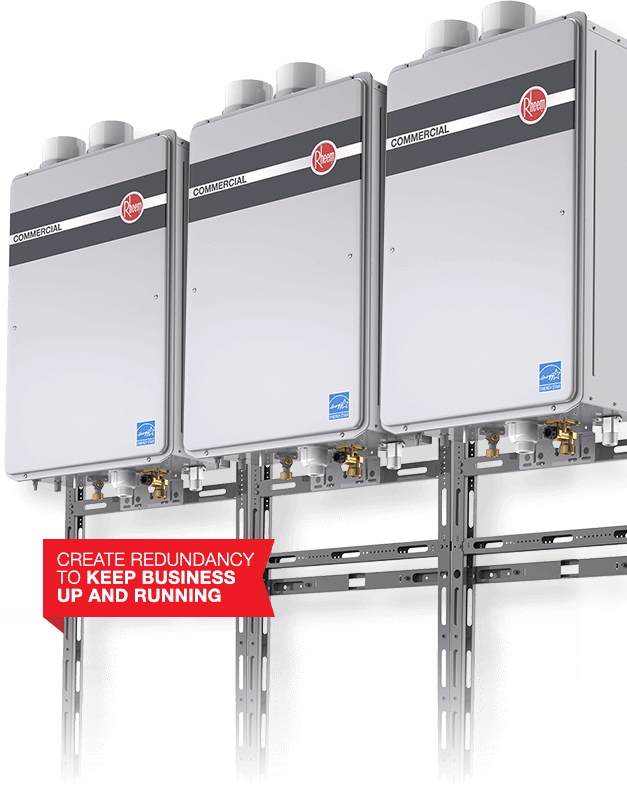

Energy star certified commercial water heaters include gas fired storage and gas fired instantaneous also referred to as tankless units that use around 15 percent less energy than conventional commercial units by employing more efficient heat exchangers.

The state of oregon is offering a tax credit for the installation of gas tankless water heaters.

That means if you installed a qualifying tankless water heater last year you could get the credit on the return you file in 2020 for 2019.

In addition homeowners may qualify for a 150 us federal tax credit with a an installed rinnai condensing boiler.

The non business energy property tax credit has been extended through 2020 and made retroactive to cover 2019.